What Tools Can Help Me Budget Effectively?

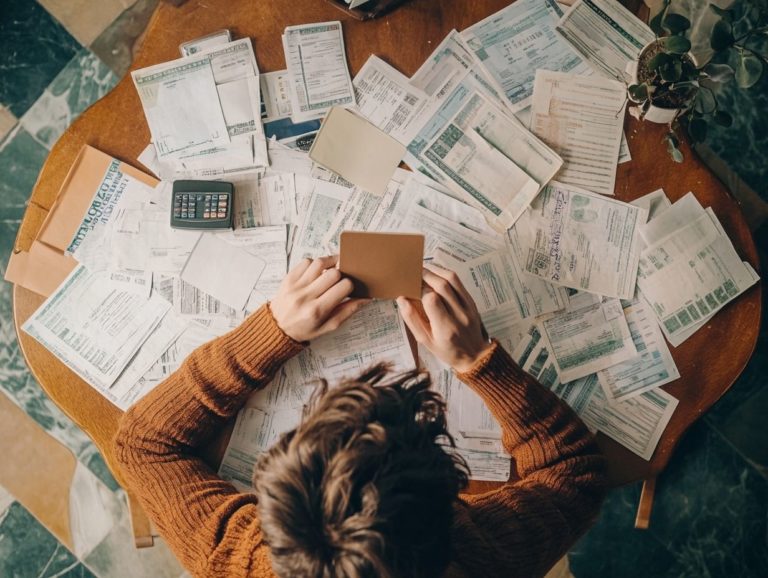

Managing your finances can indeed feel like a daunting task, but the right budgeting tools can transform the experience significantly.

This article covers a variety of budgeting tools, from manual methods to digital solutions, highlighting their unique features and benefits. It offers valuable insights on selecting the best tool tailored to your needs and shares effective strategies to maximize its potential.

You will find alternative budgeting methods that suit your personal style. Get ready to take control of your finances! With the right budgeting tool, you can turn your financial dreams into reality.

Contents

Key Takeaways:

- Budgeting tools help track expenses, set financial goals, and save money.

- Consider your needs when choosing between manual and digital tools.

- Regular reviews and adjustments can lead to better financial habits.

Why Use Budgeting Tools?

In today s fast-paced financial landscape, using budgeting tools is crucial for mastering personal finance management. These tools empower you to create a tailored budget, track your spending, and ultimately reach your financial aspirations.

Budgeting apps do more than just organize your household finances; they provide real-time insights into your financial health, helping you maintain a positive cash flow and steer clear of pitfalls like overspending or letting your savings slip away.

These apps typically boast user-friendly interfaces that make expense tracking a breeze. They allow you to categorize and monitor your spending habits effortlessly over time. By regularly analyzing this data, you can develop better financial habits, such as mindful spending and well-considered choices, leading to enhanced financial stability.

Many budgeting tools come with features designed to help you set savings goals and track your progress. With options like automated reminders and visual charts, staying on track becomes less daunting and much more achievable, transforming financial management into a gratifying journey.

Types of Budgeting Tools

Grasping the various types of budgeting tools at your disposal is essential for effectively managing your finances. These tools can differ significantly in how they assist you in crafting and sustaining a personal budget.

Whether you lean toward traditional methods, such as spreadsheets, or favor modern digital solutions like budgeting apps, each option presents distinct features and advantages designed to align with your unique financial priorities and habits.

Manual vs. Digital Tools

In terms of budgeting, the choice between manual tools and digital tools really hinges on your personal preferences and financial situation. Manual tools offer a hands-on approach to zero-based budgeting, which means you allocate every dollar you earn to a specific purpose, allowing you to dive deep into the numbers.

While digital tools bring the convenience of automated expense tracking and real-time data analysis to the table, some may enjoy the tactile experience of pen-and-paper methods. Budgeting apps simplify the process and provide invaluable financial insights.

These budgeting apps often come loaded with features like customizable categories, spending alerts, and reports that visualize your financial habits over time. This makes it much easier to spot areas where you can improve. On the flip side, manual budgeting encourages a more profound understanding of your cash flow since it requires you to actively engage with your finances.

For those who appreciate the satisfaction of physically writing down expenses, it can feel far more rewarding than endlessly scrolling through digital screens.

Ultimately, whether you lean toward manual or digital budgeting depends on your comfort with technology and your specific financial goals. It s essential to take a moment to reflect on which method aligns best with your lifestyle.

Features and Benefits of Popular Tools

Popular budgeting tools like YNAB, Mint, and Quicken are equipped with a range of features that elevate your financial management experience. They offer user-friendly interfaces that simplify tracking expenses.

With personalized insights, you can set budgets and categorize expenses. This helps you work towards achieving financial health through effective expense tracking and goal setting.

Each platform boasts its unique strengths. For instance, YNAB emphasizes active management, encouraging you to allocate your income to specific expenses and fostering a mindset focused on financial control.

Mint provides comprehensive reporting features, giving you a clear visual representation of your spending habits over time, which empowers you to make informed financial decisions. Quicken is suitable for those who need deeper analysis with advanced functionalities like investment tracking and bill management.

By comparing these tools, you can discover the perfect fit that aligns with your specific financial goals and lifestyle.

How to Choose the Right Budgeting Tool

Choosing the right budgeting tool can be a game-changer for your financial journey! It requires a thoughtful assessment of your financial situation and a clear identification of your priorities.

Consider the features that resonate most with your budgeting style. Whether you seek a cost-effective solution or wish to explore a free trial of a budgeting app, understanding your needs will illuminate the path to the most suitable tool for your personal financial management.

Factors to Consider

When selecting a budgeting tool, consider several key factors that can enhance your financial journey:

- Essential app features

- Ability to set spending limits

- Alignment with your financial habits and goals

Whether you aim to build an emergency fund or tackle debt, grasping these elements will guide you toward a budgeting solution that genuinely meets your needs.

User-friendliness is paramount; an intuitive tool can transform budgeting from a daunting task into an engaging experience. Think about compatibility with your unique financial habits. For example, the zero-sum approach means assigning every dollar of your income to specific expenses, while the 50/30/20 rule suggests spending 50% of your income on needs, 30% on wants, and saving 20%.

Evaluate specific features that resonate with your budgeting style, such as visual spending reports or mobile tracking options. These can significantly boost the tool s effectiveness.

Ultimately, the right budgeting app should fit seamlessly into your daily life, making financial planning not only manageable but also empowering.

Using Budgeting Tools Effectively

To truly harness the power of budgeting tools, embrace strategic approaches to expense tracking while aligning your budgeting methods with your long-term financial goals. This alignment fosters a healthier and more stable financial future.

By consistently monitoring your spending, leveraging reporting features, and adjusting your budgets as necessary, you can craft a sustainable financial landscape that supports your aspirations.

Tips and Strategies for Success

Successful budgeting starts with establishing strong financial habits, setting clear savings goals, and leveraging automated transactions to simplify tracking your expenses and sticking to spending limits. By consistently applying these techniques, you can enhance your budgeting effectiveness.

This consistency helps maintain a solid understanding of your financial situation. Embracing discipline in your spending is essential; it helps you differentiate between wants and needs, guiding you toward more responsible financial decisions. Flexibility in budgeting is also important, allowing you to adjust based on unexpected expenses or changes in income. This adaptability ensures you can respond swiftly while remaining committed to your long-term goals.

Try using budgeting apps to make expense tracking a breeze! These apps not only provide a real-time overview of your spending patterns but also send reminders and alerts, keeping you accountable to your budgetary commitments.

Alternatives to Budgeting Tools

While budgeting tools can be incredibly beneficial for managing your finances, you might find that alternative approaches resonate more with your unique financial habits and personal preferences.

Whether it s manual budgeting methods or innovative cash flow strategies (tracking your income and expenses), exploring these alternatives can offer you valuable insights into your personal finance journey. This way, you can discover the method that truly aligns with your financial situation and give you the power to take control of your money.

Other Methods for Effective Budgeting

Other effective budgeting methods, such as the envelope system and cash flow management, offer you a way to take control of your finances without solely depending on digital tools or apps. These approaches deepen your understanding of your financial habits and spending patterns, ultimately enhancing your financial health.

By implementing the envelope system, for example, you allocate cash to different categories of expenses like groceries, entertainment, and bills before the month begins. This physical separation of funds helps you prevent overspending and makes it easier to adhere to your budget. In cash flow management, you emphasize tracking your income and expenses to ensure you meet your obligations while identifying patterns that indicate areas for improvement.

While these methods cultivate discipline and offer tangible benefits like reduced debt, they can also present challenges, such as the hassle of using cash in a predominantly cashless society.

Frequently Asked Questions

What Tools Can Help Me Budget Effectively?

There are several tools that can help you budget effectively, such as budgeting apps, spreadsheets, and online budgeting tools.

How can budgeting apps help me budget effectively?

Budgeting apps offer features like expense tracking, bill reminders, and budgeting templates that can help you create and stick to a budget.

What free budgeting tools can you use?

Yes, there are many free budgeting tools available, such as Mint, Personal Capital, and Goodbudget. These tools offer basic budgeting features for free, with the option to upgrade for more advanced features.

Can spreadsheets help with budgeting?

Yes, spreadsheets can be a great tool for budgeting. You can create your own budgeting template or use a pre-made one to track your income, expenses, and savings.

What are the benefits of using online budgeting tools?

Online budgeting tools offer the convenience of accessing your budget from anywhere with an internet connection. They also often have advanced features like goal setting and investment tracking.

How can budgeting tools help you save money?

Budgeting tools can help you identify areas where you may be overspending and create a plan to cut back on expenses. They also track your progress toward savings goals and help you stay accountable.