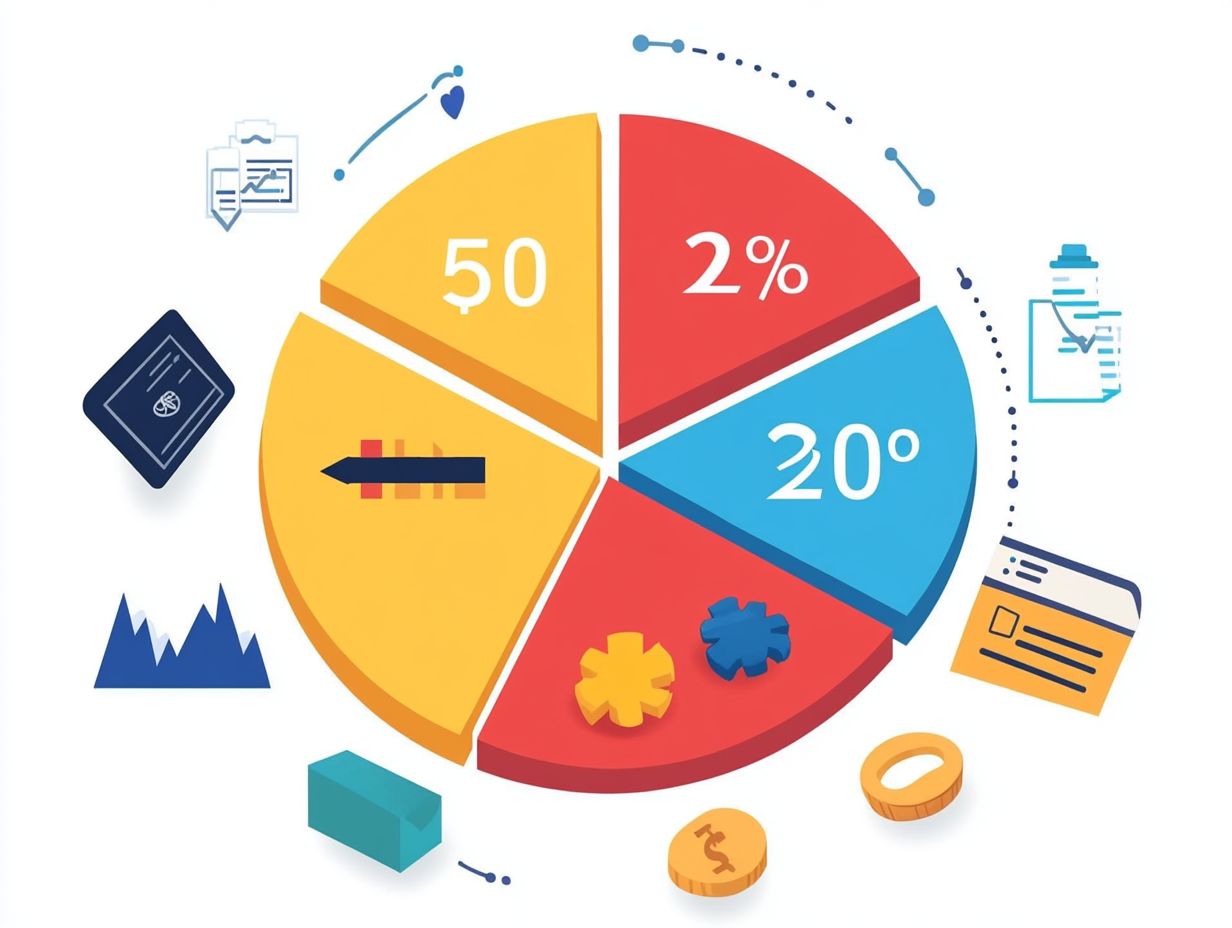

What Is the 50/30/20 Budgeting Rule?

The 50/30/20 budgeting rule offers a clear and effective strategy for managing your finances. By allocating your income into three essential categories needs, wants, and savings you can create a budget that meets your needs today while saving for tomorrow.

This guide shows you how to use this rule effectively! You’ll find tips to navigate potential challenges along the way.

Whether you’re just starting your budgeting journey or seeking a streamlined method to handle your finances, this information will set you on a path to success.

Contents

Key Takeaways:

- The 50/30/20 budgeting rule is a simple and effective way to manage your finances by dividing your income into three categories: needs, wants, and savings.

- Following the 50/30/20 budgeting rule can help with financial management by prioritizing essential expenses, limiting unnecessary spending, and promoting savings for future goals.

- To successfully implement the 50/30/20 budgeting rule, create a budget based on your income, track your expenses, and make adjustments as needed. Overcome challenges by staying mindful of your spending and savings goals.

Understanding the 50/30/20 Budgeting Rule

The 50/30/20 budgeting rule, championed by financial experts Elizabeth Warren and Amelia Warren Tyagi in their groundbreaking book, All Your Worth, is a straightforward yet powerful technique that can greatly enhance your financial journey.

This rule divides your after-tax income into three distinct categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. By adhering to this framework, you not only foster financial stability but also establish clear spending boundaries that align perfectly with your financial aspirations.

Explanation of the Rule and Its Purpose

The 50/30/20 rule is a budgeting technique crafted to help you effectively allocate your income toward essential expenses, non-essential spending, and savings. It ultimately guides you on your personal finance journey.

By dividing your income into three clear categories, this approach simplifies the often daunting task of managing finances. The first component, needs, takes up 50% of your take-home pay and covers unavoidable expenses such as housing, utilities, groceries, and healthcare.

Next, the wants segment accounts for 30%. This allows you to indulge in lifestyle choices like dining out, enjoying entertainment, and pursuing hobbies that add a spark to your life without jeopardizing your financial stability.

Finally, the savings category represents 20%, encouraging you to set aside money for future investments, emergency funds, or retirement savings. Following this framework helps you build good money habits, giving you the power to set achievable goals while enhancing your overall financial literacy.

Breaking Down the 50/30/20 Budget

Breaking down the 50/30/20 budget requires a keen understanding of how to allocate your income effectively across three distinct categories.

First, designate 50% for essential expenses, which cover necessities like healthcare and transportation.

Next, set aside 30% for non-essential spending, allowing for entertainment services such as Netflix and Disney+.

Finally, allocate 20% for savings, which should include your emergency funds and contributions to retirement accounts like IRAs or 401(k)s.

This smart strategy lets you enjoy life now while preparing for your future!

Start your budgeting journey today and take control of your finances!

Mastering Your Budget with the 50/30/20 Rule

Allocation of Income

The 50/30/20 budgeting rule offers a simple yet effective framework for allocating your income into three distinct categories: essential expenses, non-essential spending, and savings.

By grasping these categories, you will empower yourself to take charge of your finances and work towards achieving your financial aspirations.

Essential expenses cover the must-haves, such as gasoline, housing, utilities, and healthcare. These are the non-negotiables that you need to budget for each month.

Non-essential spending, however, is where you can have a bit of fun. This includes leisure activities like dining out, entertainment, and hobbies areas you can adjust if the need arises. By evaluating these categories, you can prioritize your savings for crucial goals like building an emergency fund or paying off debt, setting yourself up for a more secure financial future.

Why Use the 50/30/20 Budgeting Rule?

Embracing the 50/30/20 budgeting rule brings a wealth of benefits to your financial management. This strategy simplifies the budgeting process while cultivating financial stability.

This balanced approach promotes greater control over your finances and leads to a more secure future.

How It Will Transform Financial Management

The 50/30/20 rule will elevate your financial management by offering a clear framework for budgeting that helps you prioritize your spending and savings effectively.

By allocating 50% of your income to necessities, 30% to non-essential spending, and 20% to savings and debt repayment, you can gain better control over your finances. This structured approach not only prevents you from overspending on non-essential items but also encourages responsible management of credit card debt by earmarking funds specifically for repayment.

For instance, utilizing budgeting apps like You Need A Budget or Mint can simplify the process of tracking these categories, making it easier for you to visualize your spending patterns and adjust as necessary.

The 20% set aside for savings can be directed toward building an emergency fund, allowing you to feel more secure and prepared for any unexpected expenses that may arise.

Implementing the 50/30/20 Budgeting Rule

Implementing the 50/30/20 budgeting rule involves a series of straightforward steps designed to help you create and adhere to a monthly budget that aligns seamlessly with your household finances and financial aspirations.

This approach ensures that you cultivate a well-organized financial strategy tailored to your unique needs.

Steps to Create and Follow the Budget

Creating and adhering to a budget using the 50/30/20 rule requires you to first identify your income sources. Then categorize your expenses into needs, wants, and savings.

Regularly reviewing your household finances will help you maintain financial stability.

To effectively implement this method, consider utilizing various budgeting tools such as apps or spreadsheets that can simplify your expense tracking. By allocating 50% of your income to essential needs like housing, utilities, and groceries you ensure that your basic living standards are met.

Next, direct 30% toward non-essential spending, which includes dining out and entertainment. This adds joy to your life while still maintaining financial responsibility. Reserve 20% for savings and debt repayment.

Regularly evaluating your spending patterns not only aids in understanding your financial health but also allows for adjustments as your circumstances change. This highlights the necessity of flexibility in achieving your long-term savings goals.

Potential Challenges and Tips for Success

While the 50/30/20 budgeting rule serves as an effective framework for managing personal finances, you may encounter several challenges along your financial journey.

To navigate these obstacles successfully, it s essential to employ strategic tips that will empower you to thrive.

Start your budgeting journey today for a financially secure tomorrow!

Overcoming Obstacles and Staying on Track

Overcoming obstacles and staying on track with the 50/30/20 rule demands a proactive approach to budgeting. Regularly monitoring your expenses and making adjustments are key to aligning with your financial goals.

To ensure your success, set periodic reminders for reviewing your budget. This practice helps you maintain focus and adapt to any changes in your life that arise.

Using budgeting apps can streamline tracking your expenditures in real-time. These tools provide insights that empower you to make informed decisions.

Sharing your financial goals with friends or family can spark motivation and encouragement. This makes the journey toward achieving your financial objectives not only more manageable but also more enjoyable.

Frequently Asked Questions

What is the 50/30/20 Budgeting Rule?

The 50/30/20 Budgeting Rule is a popular personal finance strategy. It suggests allocating 50% of your after-tax income your income after taxes towards needs, 30% towards wants, and 20% towards savings and debt repayment.

How do I calculate my 50/30/20 budget?

To calculate your 50/30/20 budget, start by determining your after-tax income. Then, multiply that number by 0.50 for needs, 0.30 for wants, and 0.20 for savings and debt repayment.

Why is the 50/30/20 Budgeting Rule effective?

The 50/30/20 Budgeting Rule is effective because it provides a balanced approach to managing your finances. To enhance your budgeting strategy, consider exploring what the 80/20 rule in budgeting can offer. It ensures you meet your basic needs while allowing for discretionary spending and saving for the future.

Is the 50/30/20 Budgeting Rule suitable for everyone?

This rule is popular and effective but may not work for everyone. Consider your individual financial goals and circumstances before implementing it.

What are some ways to cut down on expenses in the 50/30/20 budget?

If your needs category takes up more than 50% of your budget, look for ways to reduce those expenses. This could include finding lower-cost alternatives or negotiating bills with service providers.

Can I adjust the 50/30/20 Budgeting Rule to fit my needs?

Yes, you can adjust the 50/30/20 Budgeting Rule to fit your individual needs and financial goals. For instance, allocate a higher percentage towards savings if you’re aiming for a specific financial goal, like buying a house or paying off debt.