Is Budgeting Only for People in Debt?

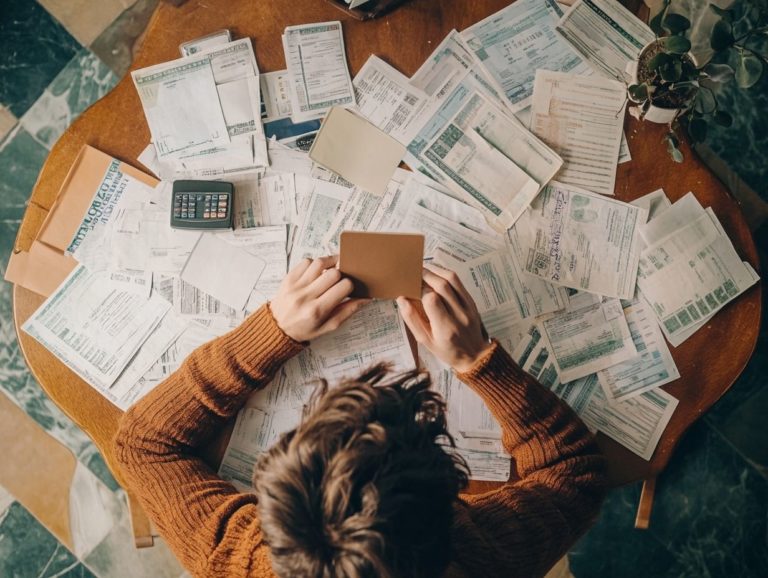

Budgeting is often mistakenly viewed as a tool only for those grappling with debt. In reality, it s essential for anyone aiming to achieve financial stability and reach long-term goals. This article delves into the true purpose of budgeting, showcasing its many benefits that extend far beyond mere debt management.

You ll discover and debunk common misconceptions while also receiving practical steps to create a budget that works for you. Tailored tips will be provided for various income levels and financial aspirations, ensuring that you find the guidance you need. Join us to discover how budgeting can take charge of your finances!

Contents

Key Takeaways:

Remember, budgeting isn t just for those in debt. It s a powerful tool for everyone aiming for financial stability!

By creating and sticking to a budget, individuals of all income levels can effectively manage their finances and make progress toward their financial goals.

Don t let the misconception that budgeting is only for managing debt hold you back. It s a valuable tool for financial success, no matter your current situation.

Understanding Budgeting

Grasping the details of budgeting is essential for achieving financial stability and realizing long-term financial aspirations. Budgeting allows you to monitor your spending habits and create an emergency fund, ensuring you’re prepared for unforeseen expenses.

By establishing a clear spending plan, you can allocate resources effectively toward crucial savings, curb unnecessary overspending, and take charge of your personal finances. This foundational knowledge is vital for navigating the complexities of consumer spending and securing a financially sound future.

Defining Budgeting and its Purpose

Budgeting is your systematic approach to managing finances, crafted through a well-defined plan that details all your income and expenses. This strategic framework plays a vital role in your financial planning, enabling you to allocate resources effectively and make informed choices about your spending.

By establishing a clear overview of your money inflows and outflows, budgeting encourages a disciplined mindset. It helps you prioritize essential needs, set aside savings, and ultimately reach your financial goals.

Tracking both your income and expenses is essential; it fosters awareness of your financial habits and allows you to make necessary adjustments. This ensures that your lifestyle remains aligned with your long-term aspirations and objectives.

Benefits of Budgeting

The benefits of budgeting go well beyond simple money management. It creates financial stability, encourages effective savings, and helps you achieve your long-term goals, like building a substantial emergency fund.

By following a structured budget, you can significantly cut down on credit card debt the money you owe on credit cards and boost your ability to save for retirement, effectively laying the groundwork for financial independence.

This strategic approach allows you to have better control over discretionary spending, meaning spending on non-essentials like entertainment or dining out, while ensuring that your actual expenses are accounted for. This ultimately fosters a secure financial future.

Financial Stability and Long-Term Goals

Achieving financial stability is often intricately linked to establishing and committing to long-term financial goals, like retirement savings and maintaining a healthy emergency fund. This shows why having a structured plan is important, allowing you to set aside funds for future needs while building a robust safety net for unexpected expenses.

By prioritizing savings, especially for retirement, you can create a cushion that enables you to focus on your long-term aspirations without the constant shadow of financial uncertainty. To bolster your financial health, consider allocating a portion of your income to an emergency fund, ideally targeting three to six months’ worth of living expenses.

This proactive approach not only alleviates stress but also shields you from unforeseen circumstances, ensuring you stay on track to achieve your significant goals. Start budgeting today and watch your financial dreams become a reality!

Common Misconceptions about Budgeting

Common misconceptions about budgeting often lead people to think it s just a way to restrict spending. Many believe it focuses solely on cutting costs and managing credit card debt. In truth, budgeting is a way to improve your finances. It offers a clear roadmap to achieving your financial goals rather than just being a tool for debt control.

By dispelling these myths, you can embrace budgeting as a pathway to financial independence and stability. It allows for responsible spending that aligns with your aspirations.

Busting the Myth of Budgeting for Debt Management Only

Many think budgeting is just about debt. In reality, it helps you set goals and save money too. A budget allows you to tackle current obligations while paving the way for a secure financial future.

Thoughtful planning involves setting aside funds for unexpected emergencies. This can significantly reduce stress from sudden expenses. It also means prioritizing contributions to your retirement accounts.

A well-structured budget becomes a powerful tool for achieving overall financial stability. It helps you allocate resources toward important life milestones, like buying a home or funding an education. Budgeting supports your immediate needs and long-term aspirations.

How to Create and Stick to a Budget

Creating and sticking to a budget is crucial for enhancing your financial situation. It allows you to manage monthly expenses with confidence while directing savings toward your financial aspirations.

A carefully crafted spending plan sharpens your awareness of actual expenses and helps you make informed choices about discretionary spending.

This journey involves evaluating your current financial status, pinpointing necessary adjustments, and committing to consistent monitoring to ensure you stay on course.

Steps for Building a Budget and Staying on Track

Building a budget involves several key steps for your financial success. Start with a thorough assessment of your income, track your monthly expenses, and define clear financial goals to guide your savings.

- Begin by creating a comprehensive list of all sources of income. This lays a solid foundation for understanding what you have available to work with.

- Next, meticulously track your monthly expenses, categorizing them into fixed costs and variable costs. Fixed costs are expenses that stay the same each month, like rent, while variable costs can change, like groceries. This helps you gain insights into your spending habits and identify where you can save.

- Establish specific, measurable financial goals like saving for that dream vacation or paying off debt. These serve as motivating benchmarks.

- Regularly review your budget to maintain accountability. Make adjustments as your income fluctuates or unexpected expenses arise. This reinforces the importance of adaptability in your financial journey.

Budgeting Tips for Different Financial Situations

In budgeting, one size certainly does not fit all. It s essential to tailor effective strategies to your specific financial situation and income level. This allows you to meet your unique financial goals.

Whether you re on a fixed income or expecting a salary increase, understanding the nuances of budgeting can help you maximize savings and minimize overspending, regardless of your circumstances.

Don’t wait start budgeting today!

Budgeting for Different Income Levels

Your budgeting strategy changes with your income level, necessitating tailored approaches to achieve your specific financial goals and manage expenses effectively.

For instance, if you re a low-income earner, you ll likely need to prioritize essential expenses like housing and food while finding ways to make every dollar stretch. A zero-based budget could be your best friend here, ensuring that every penny has a purpose and no funds go unutilized.

If you find yourself in the medium-income bracket, you have the opportunity to strike a balance between savings and lifestyle. This means setting aside a certain percentage of your income for discretionary spending while regularly contributing to an emergency fund and retirement accounts.

On the flip side, if you enjoy a high income, your focus might shift toward tax-efficient investment strategies and wealth-building opportunities, aimed at further enhancing your financial portfolio.

Start implementing effective savings methods today to secure your financial future, ensuring that you meet both your immediate and long-term financial goals.

Budgeting for Different Financial Goals

Different financial goals, whether it’s saving for an emergency fund or planning for retirement, demand tailored budgeting strategies and approaches.

To effectively navigate these goals, you should start by assessing your current financial situation, pinpointing areas where adjustments can be beneficial. For example, creating a prioritized list of objectives will help you focus your savings efforts more effectively.

It’s wise to allocate a specific percentage of your monthly income toward an emergency fund aim for three to six months’ worth of expenses as your safety net.

For retirement, consider participating in employer-sponsored plans or individual retirement accounts (IRAs), which can offer tax advantages while you steadily build a substantial nest egg. Balance your immediate needs with your long-term goals. Each financial goal deserves attention.

Frequently Asked Questions

Is Budgeting Only for People in Debt?

No, budgeting is not only for people in debt. In fact, budgeting is important for everyone and is a valuable financial tool that can benefit anyone, regardless of their financial situation.

Why should I budget if I am not in debt?

Budgeting can help you better manage your money and reach your financial goals. It can also help you save money, plan for future expenses, and have a better understanding of your financial situation.

Is budgeting only for people with a low income?

No, budgeting is important for people of all income levels. It can help you make the most of your money and ensure that you are not overspending or living beyond your means.

Can budgeting help me get out of debt?

Yes, budgeting can be a useful tool for getting out of debt. By creating a budget and sticking to it, you can better manage your expenses and pay off your debts more effectively.

Do I need to be good at math to budget?

No, budgeting does not require advanced math skills. There are many budgeting tools and resources available that can help you create and manage a budget, even if you are not great at math.

How do I start budgeting if I have never done it before?

The first step to budgeting is to track your expenses and income. You can use a spreadsheet, budgeting app, or even pen and paper to create a budget. There are also many online resources and budgeting templates available to help you get started.

Take control of your finances today by starting a budget!